CAAM Announces Recipients of 2023-2024 Stanley and Marvel Chong Scholarship

14 senior year students from 12 high schools or home school in…

14 senior year students from 12 high schools or home school in twin cities were selected to receive 2023-2024 CAAM…

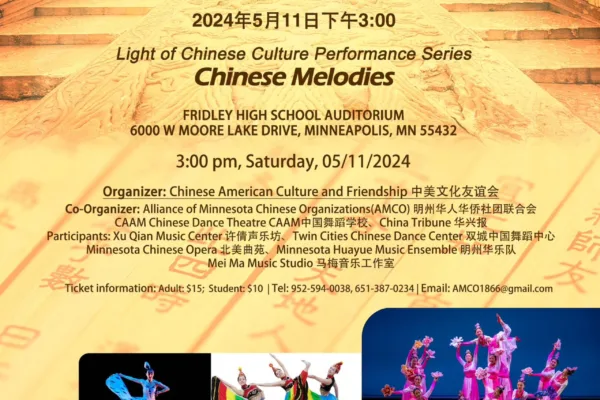

Light of Chinese Culture Performance Series Fridley High School Auditorium 6000 W Moore Lake Drive, Fridley, MN 55432 3:00 PM…

From May 4-26, 2024, History Theatre and Theater Mu’s world premiere Blended 和 (Harmony): The Kim Loo Sisters will shine…

Following the unreasonable interrogation and denial of entry at Washington International Airport, leading to the deportation of several Chinese students,…

YOU’RE INVITED! Join us for CAMOC’s 23rd Benefit Gala Dinner Saturday, May 18th, 2024 at New Furama Restaurant More details: https://ccamuseum.org/

2024 Chinese American Convention “Chinese American Convention,” organized by United Chinese Americans (UCA), is the largest national get-together event, the…

California’s Ron and Lloyd Dong brothers donated $5 million in ancestral property to San Diego State University’s Black Resource Center…

College of Liberal Art 2nd Floor Hallway with exhibits on display By Greg Hugh Poetic Visions, an exhibit featuring selections…

4:00 PM | Thursday, April 25, 2024 McNamara Alumni Center Under President Xi Jinping’s leadership, China has increased its defense spending,…

Annual Data on Minnesota Manufactured Exports – Published in March 2024 For More Information: Mary Haugen ([email protected]) Minnesota exported about…

Minneapolis Institute of Art (Mia) presents “Year of the Dragon: Mystical Creatures of the Sky,” an exhibition celebrating the lunar…

By ABBY BUDIMAN, JEFFREY S. PASSEL AND CAROLYNE IM, Pew Research Center Asian Americans have been the fastest-growing group of eligible voters in…