BLENDED 和 (HARMONY): THE KIM LOO SISTERS

From May 4-26, 2024, History Theatre and Theater Mu’s world premiere Blended…

From May 4-26, 2024, History Theatre and Theater Mu’s world premiere Blended 和 (Harmony): The Kim Loo Sisters will shine…

Following the unreasonable interrogation and denial of entry at Washington International Airport, leading to the deportation of several Chinese students,…

YOU’RE INVITED! Join us for CAMOC’s 23rd Benefit Gala Dinner Saturday, May 18th, 2024 at New Furama Restaurant More details: https://ccamuseum.org/

2024 Chinese American Convention “Chinese American Convention,” organized by United Chinese Americans (UCA), is the largest national get-together event, the…

California’s Ron and Lloyd Dong brothers donated $5 million in ancestral property to San Diego State University’s Black Resource Center…

College of Liberal Art 2nd Floor Hallway with exhibits on display By Greg Hugh Poetic Visions, an exhibit featuring selections…

4:00 PM | Thursday, April 25, 2024 McNamara Alumni Center Under President Xi Jinping’s leadership, China has increased its defense spending,…

Annual Data on Minnesota Manufactured Exports – Published in March 2024 For More Information: Mary Haugen ([email protected]) Minnesota exported about…

Minneapolis Institute of Art (Mia) presents “Year of the Dragon: Mystical Creatures of the Sky,” an exhibition celebrating the lunar…

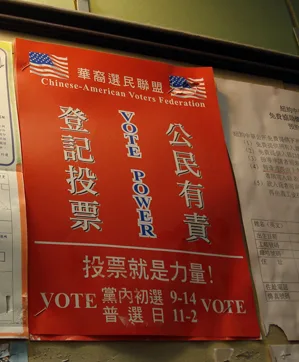

By ABBY BUDIMAN, JEFFREY S. PASSEL AND CAROLYNE IM, Pew Research Center Asian Americans have been the fastest-growing group of eligible voters in…

Greg Hugh, China Insight Here are some insights into what to consider when looking for books on how Chinese Americans…

New Non-Profit Launched to Support AAPI Veterans in Minnesota Saint Paul, MN – Feb. 23, 2024 – The Minnesota AAPI…